The following article by financial consultant Russell Beaumont discusses how the Risk Type Compass can tell us a lot about the risk personality of investors – how they think and communicate about financial risk as well as their risk appetite. It was first published in Investment Week in December 2016.

Plenty of effort has gone into testing the contents of financial communications, trying to give enough information so that clients know what they’re getting into, but not so much as to put them off.

The content and layout of the Key Information Document (KID) will be largely prescribed by legislation. The assumption is that customers, presented with suitably summarised key information, make appropriate decisions.

But that is only half the picture – determining a customer’s risk personality can help smooth the process too.

Risk-Taking Behaviour

Psychologists PCL identify two key factors that determine a customer’s approach to risk taking. Firstly, risk type reflects their natural disposition – what extent people are, for example, usually optimistic or anxious, a careful planner or impulsive.

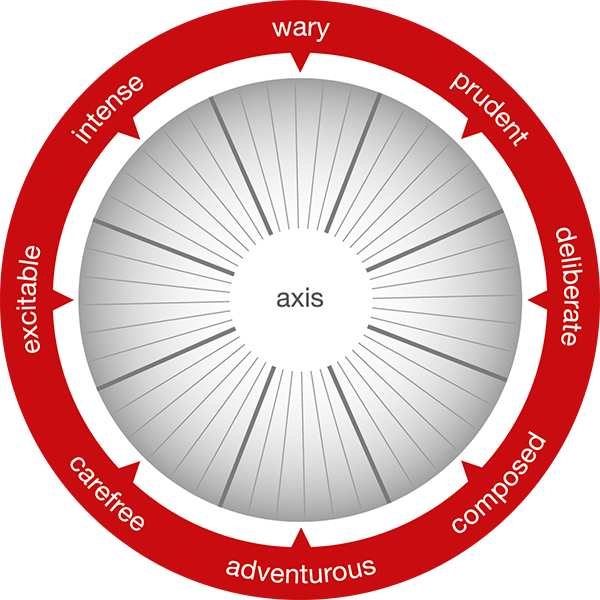

Risk Type is deeply rooted and influences how much risk they are willing to take, how much uncertainty they can cope with and how they react when things go wrong. An assessment places you in one of eight categories on the Risk Type Compass (see below).

Secondly, Risk Attitude looks at how experience and personal circumstances contribute to risk-taking behaviour. Whereas Risk Type is deeply rooted, Risk Attitude depends on experience and circumstances. For example, wealth, age, financial know-how and the importance of an investment can all influence a customer’s willingness to take financial risk.

Risk Type and Risk Attitude are combined in the Risk Tolerance index. The diagram below shows how a deliberate investor might map to the risk tolerance index.

Talking Over the KIDs

KIDs will summarise the investment risk of a product on a scale from 1 to 7, so potential investments are mapped to potential investors. But that ignores the human factors involved.

Risk tolerance varies according to the customer’s Risk Type. But so does their entire approach to making risk-based decisions. Understanding the decision-making process from the perspective of risk personalities and taking a customer through the journey best suited for them will reduce the friction in reaching a decision.

A survey found air traffic controllers to be overwhelmingly and intensely deliberate in their risk-taking. They are calm and calculated, test the ground thoroughly, prefer following rules and are happier when well-prepared.

In short, they feel risk differently to people in other risk types. Communications about risk to deliberate investors, including air traffic controllers, will be more effective working alongside their preferred style.

Being a deliberate risk type does not mean being risk averse. Once they understand the plan, they are happy to take greater amounts of risk if that’s the right decision. But they are much more comfortable when the plan and the details are understood during the process.

Contrast that with someone who is wary. Their risk personality combines emotion with persistent scepticism. They prefer established ways of doing things, respect tradition and protect themselves by being vigilant, conservative and systematic.

Emphasising the history of the provider and the ability to track and control investments can reassure a Wary type of an appropriate decision.

So even though the content and format may be prescribed, signposting options to find additional information or reinforcing certain risk messages can help customers feel more comfortable with their decisions. Historically, this is a natural part of an adviser’s value-add. However, attitude-to-risk tools are now a standard part of the buying process.

The same approach can work in a remote advice context, where information and features that the customer will naturally seek out, or that perhaps should be reinforced, can be made more prominent.

And it’s easy to see applications beyond retail investments. For example, pension trustees can understand how the attitude-to-risk of scheme members matches the default investment options and how best to communicate with those members.

Imagine, for example, being the trustees of a scheme of air traffic controllers.