Accurate identification of these all-important risk instincts will enhance decision-making performance at all levels of the organisation

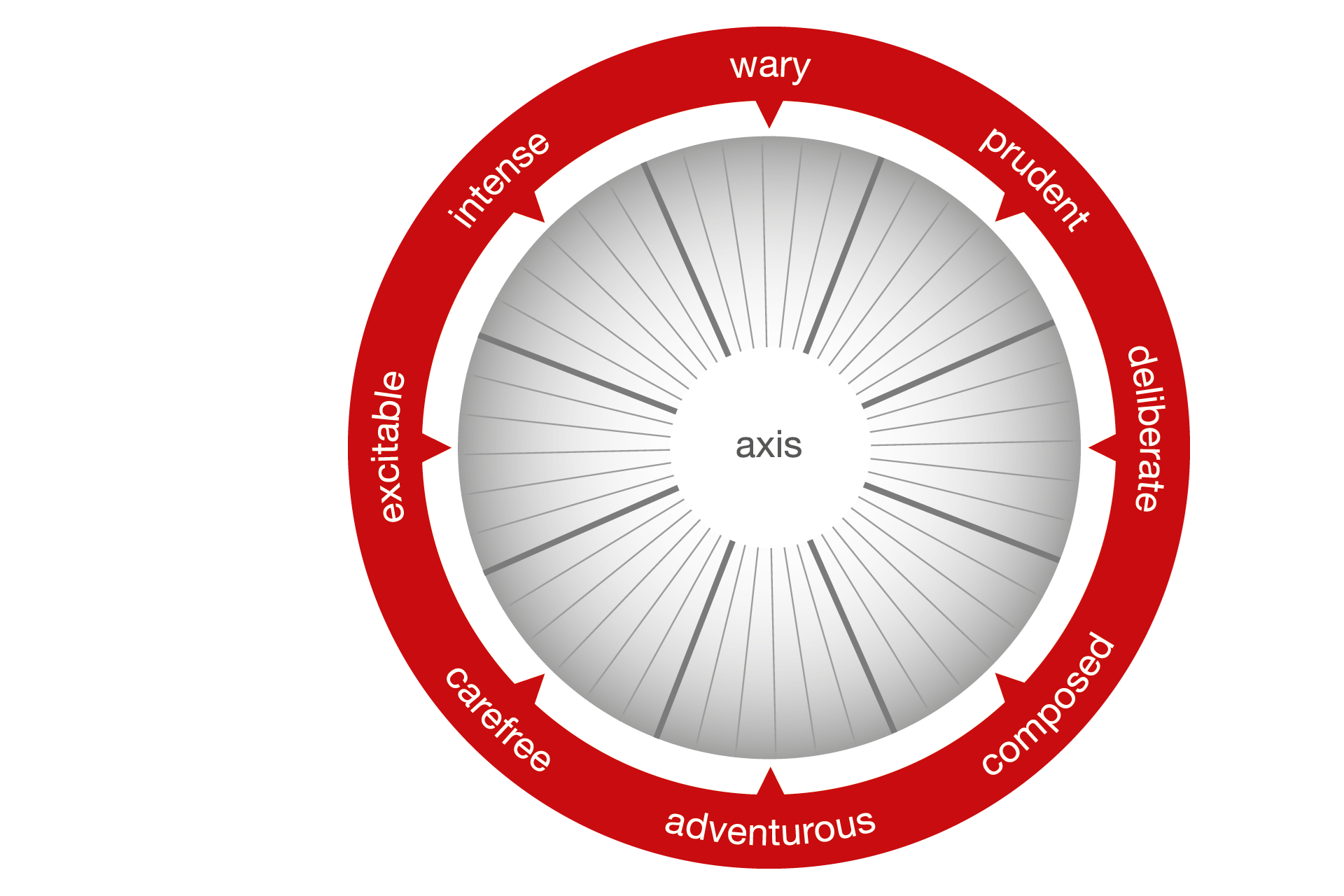

Neuroscience identifies the personal biases that come into play whenever we make decisions. Two independent systems contribute to this, Emotion (how anxious or fearlessly risk-embracing we are) and Cognition (the degree to which we can tolerate uncertainty or need to make sense of everything). Emotion and Cognition combine in predictable ways to establish each individual’s distinctive decision-making style. Research demonstrates how these individual differences in risk instinct are compounded within the dynamics of group thinking, creating the undercurrents that shape our decision making.

How to implement the Risk Type Compass decision-making tool within your workplace

To administer the Risk Type Compass questionnaire, you must complete a qualification workshop, either live on Zoom or on demand via our online learning platform.

This certification course provides extensive information about how to interpret and give feedback on an individual’s Risk Type Compass profile, guidance on facilitating team development sessions as well as an overview of how to apply the tool to support organisational effectiveness. Alternatively, we offer an extensive consultancy service to support your use of the Risk Type Compass and enhance decision-making effectiveness, by delivering feedbacks and team workshops.

View and order RTC reports

Visit our training menu

- Find and book your Risk Type Compass certification and advanced courses

Explore our consultancy services

- Learn how our work will enhance decision-making effectiveness

- Discuss how we develop your key talent

- Discover our team workshops

Lorraine Lynch

Chief Audit Executive, National Grid plcAs the Chief Audit Executive, I understand how important it is to have a high-performing team and I see psychological safety as a key building block to our team success. A key step in our journey was utilising the Risk Type Compass tool to improve our team dynamics and increase self-awareness. As a team of audit professionals, understanding our risk types is key to ensuring that our diverse perspectives are understood and leveraged as part of our decision-making process and how we engage with each other and key stakeholders across the business. Our sessions with Elliot Philips supported our ability to build on psychological safety, understand the impact and benefit of diverse perspectives in our work, and build mutual respect and trust across the team. Understanding our individual risk types along with those of our team members enabled the team to take accountability for their own risk type and embrace how we build an environment that allows all to bring their whole selves to work.